Following the jilted tie-up between 7-Eleven (Seven & I Holdings) and Circle K (Alimentation Couche-Tard), Seven & I updated investors on its growth strategy. (Here we will speak solely of the US business. Additionally, the IPO plans for the US remain.) The strategy includes expanding its private label food offering and quality to raise consumer perceptions in regards to distinctiveness, “taste,” and value, but especially as it relates to fresh and prepared meals. (The trend towards more high-quality, good-value prepared meals as an alternative to fast food has been a focus in our blog this year.) Currently, 1080 7-Eleven locations (out of 12K) have restaurants. They intend to double the number by 2030. (Restaurant locations do $6.9K in daily sales vs. the control at $5.2K.) Additionally, they intend to increase the number of new stores (in the new format by 1300 locations by that time. (The new format does $8.2K in daily merchandise sales vs. $5.7K prior to the upgrade). There was no discussion of the Speedway brand (also operated by Seven & I).

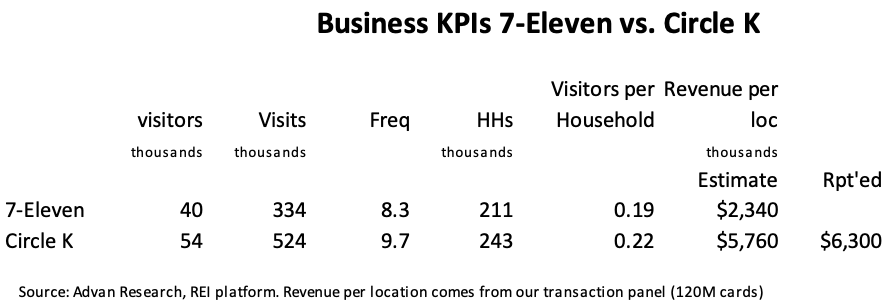

Contrasting 7-Eleven location productivity to Circle K is illustrative of the opportunities in front of them. Circle K attracts 35% more visitors and 60% more visits on average than 7-Eleven. Circle serves more households and penetrates that footprint with more depth. They also drive substantially more spend-per-visit with revenue per visit higher by 55%. Combined, these conspire to deliver over twice the sales productivity. That leads to a superior level of profitability with Alimentation Couche-Tard at a 5.5% operating margin vs. 7-Eleven’s 2.5%. Moreover, the 5.5% is substantially diluted by the lower margin it makes on gas sales in Canada and Europe.

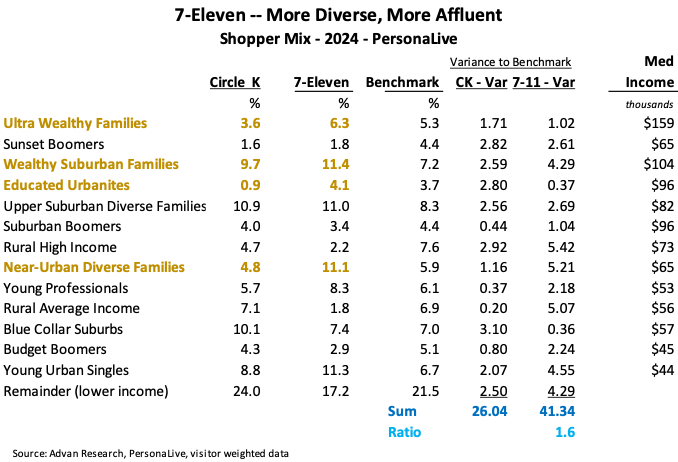

Speaking of opportunity, when looking at the shopper mix between the two operators, one would expect Circle K’s greater sales productivity to stem from a more affluent customer, however, as shown in the table below, 7-Eleven has vastly higher level of affluence (10%) in its customer mix, as well as a vastly more diverse mix than the national benchmark (1.6X that of Circle K). This suggests that it has ample opportunity to micro-merchandise its stores to tailor mix to the trade area profile to vastly improve the relevance and profit-mix-enhancement.

LOGIN

LOGIN