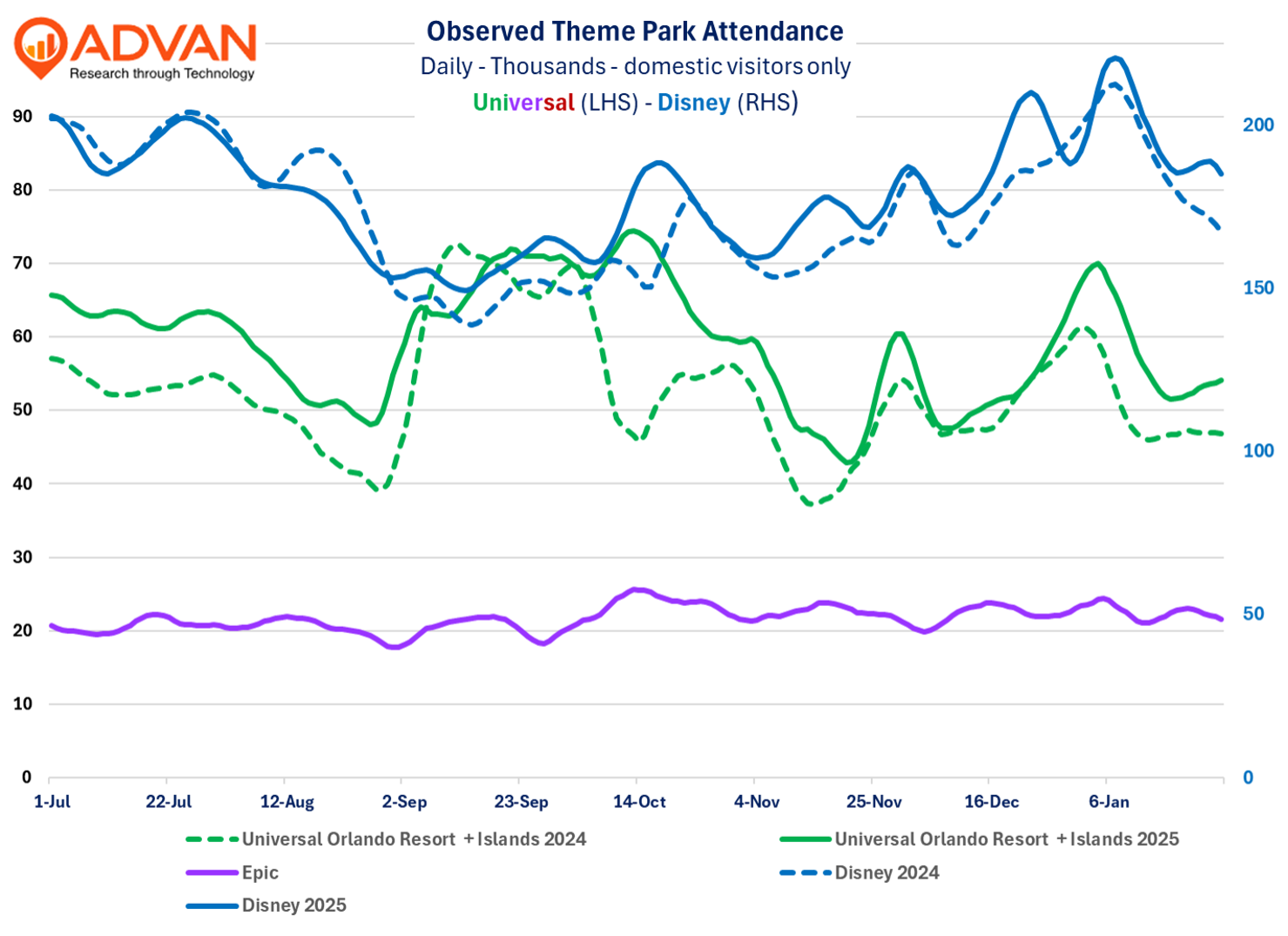

- Disney reported stronger domestic park results for the December quarter, despite Universal also reporting stronger results in Orlando. Attendance for Disney increased +1%, along with growth in average admission price, per-cap spending, and hotel occupancy, led by Orlando and despite a material decline in international visitation to Disney World and Disneyland.

- Given the large size of Disney World and Universal Orlando, that both simultaneously grew rate and attendance demonstrates that the new Epic Universe park grew the overall Orlando market. Disney’s report also showed that they are increasing Disney World’s service levels and capacity at (more labor hours and more attractions / attraction on-times).

- The positive outlooks by Disney and Universal demonstrate strong demand (bookings) for the important summer season. However, that both of these large operators remain in expansion mode in terms of capacity / attractions suggests a more difficult upcoming season for direct competitors.

As previewed , domestic attendance to Disneyland and Disney World strengthened* QoQ around +300bps to +2% YoY growth, benefiting from its compelling storytelling and attractions, leverage to more affluent households, and lapping disruptive Hurricane Milton in the base period. (Disney reported +1% increase in attendance, a figure that was held back due to lower international visits to Disneyland / Disney World, a population that our data does not observe. Adjusting for the international headwind implies the +2% figure.) The increase came alongside Universal also reporting strong attendance, and both operators reported strong per-cap metrics and not promotional discounts to “borrow market share.” Disney reported a +4% increase in average per-capita ticket revenue. The attendance / affluence dynamic also drove a +4% increase in in-park per-cap spending and a +200bps increase in hotel occupancy (when excluding international visitation, both figures will have been higher.)

The Domestic Parks’ strong top-line (+7%) was matched by a strong bottom-line (+8%); however, the slight earnings leverage to pricing was perhaps less than some expected. More guest service hours and the cost of new attractions, while fueling the attendance gains, limited the earnings flow-through. (It’s possible that part of the increase in Advan’s observed visits was due to the more service hours.) Nevertheless, the high guest satisfaction and favorable brand appeal are evident in the Park forward bookings at +5% from the remainder of the fiscal year (leverage to more affluent households also helps, a decline in international bookings hurts).

See our last write-up on industry trends here and here .

‘*FQ4’s attendance to the domestic figure was not explicitly reported, Morgan Stanley has it as -2%. Relatedly, for FQ4’25, management did not explicitly call out international as a headwind, whereas for FQ1 they did. We take this to be a -100bps QoQ. And so, FQ4 was “reported” at -2%, for FQ1 it’s +1% including the -100bps from international, or +2% underlying, which totals a +400bps QoQ swing for domestic visitors to the domestic parks.

Advan’s normalized observed visits were +3.6% for the December quarter, +520bps QoQ. The amplification of our data (vs. the reported-implied +400bps) likely stems from data noise caused by Hurricane Milton, something that we have witnessed across industries (and perhaps a little from the increased staffing). More specifically, observed visits to Disneyland were flat for the December quarter, whereas Disney World observed visits increased +7%, which is unrealistically high and inclusive of “noise.” The chart shows that Milton had a larger impact on Universal than Disney.

LOGIN

LOGIN