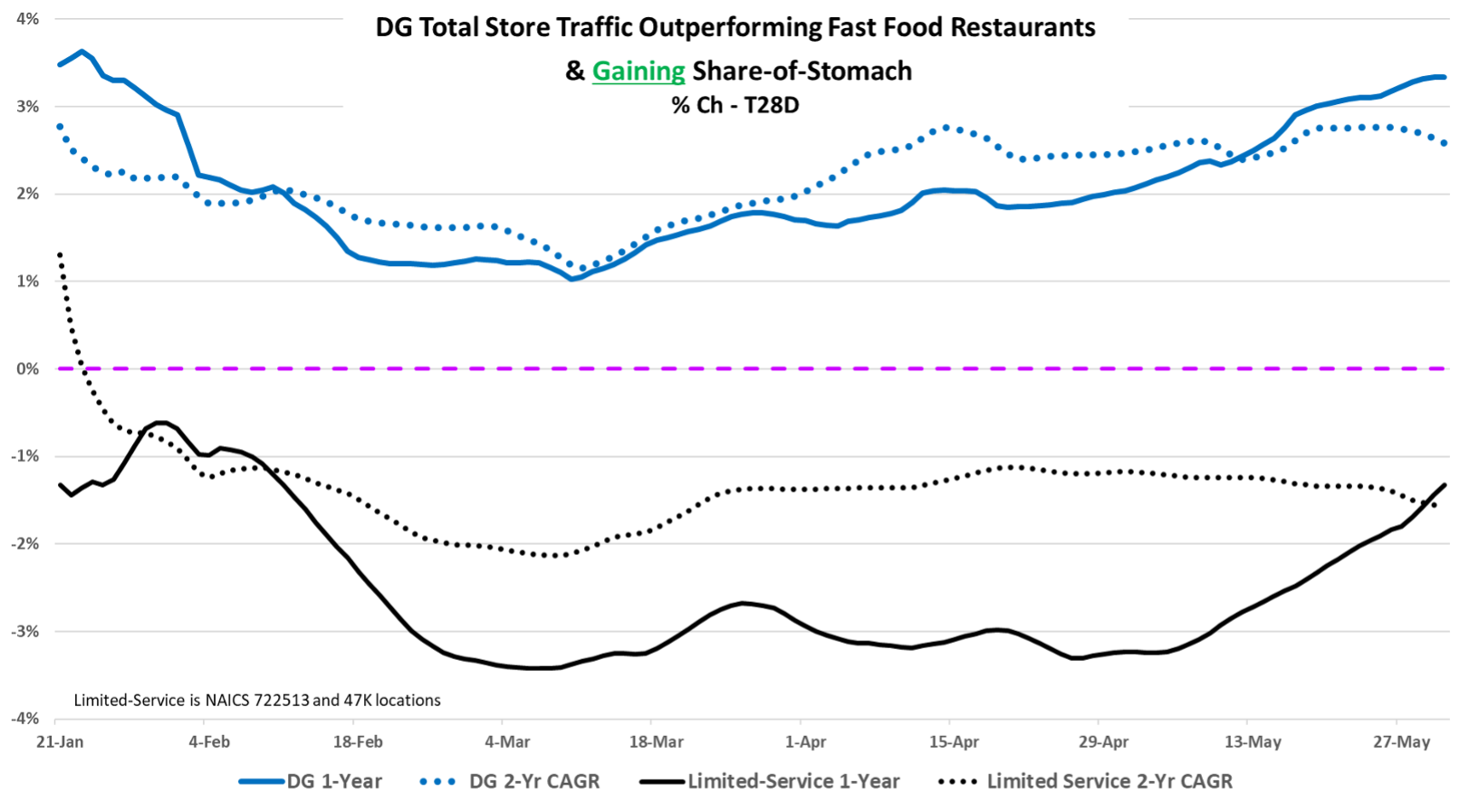

Dollar General results were stronger than expected, including Advan’s. Comp-sales increased by +2.4%, whereas we expected a +1.2% increase. Our estimate “miss” was a result of General closing an unusually large number (168) of dog stores. General typically closes 90 stores annually. Thus, this cycle was 7.5X greater, which adversely impacted foot traffic, but which also likely juiced the comp as the dogs were no longer a drag. General also only opened 156 new locations vs. FQ1’s typical 200+. As such, there was less of a drag from new store performance (NSP). We can see the effects from both in transactions-per-square-foot, which went from down -2.2% in FQ4 to -0.8% this quarter. If we adjust for that, our estimated traffic improved by +60bps QoQ, right in line with the reported comp-transaction improvement of +80bps. We suspect that the improved traffic is the result of consumers shifting where they are getting their calories, i.e. to grocery (at-home consumption) and away from the relatively higher priced consumption at restaurants. One can see that in the weaker traffic for limited-service restaurants in the chart below. (The 2-year CAGRs are a better view of the underlying trend – ongoing share shift.) Additionally, General’s comp-ticket benefited from more items in the basket (UPTs), which came from the consumables category, i.e. more calories. General also shared that April was the strongest month of the quarter (as it was in traffic as well), with the month benefiting from the later Easter, but as shown, the strength has persisted into June.

On the earnings call, CEO Todd Vasos said, “Our data shows that new customers this year are making more trips and spending more with us compared to new customers from last year, while also allocating more of their spend to discretionary categories. We believe these behaviors suggest that we are continuing to attract higher-income customers who are looking to maximize value while still shopping for items they want and need. To that end, in Q1, we saw the highest percent of trade-in customers we’ve had in the last four years.” Advan doesn’t know about the last four years, but Advan+Spacial.ai segmentation show that important Rural High / Average Income cohorts, which make up 27% of General’s customer, increased visits at a 2.7% rate, outperforming the overall visits increase of +2%, or said differently in management speak, “this important consumer set, which has a median household income of $95K, grew at a 35% faster rate than average.” Wow! However, this was the second quarter in a row of better general merchandise sales and the category’s comp sales improved to +2.7% growth, the first positive figure since 2021, also supporting the claim that the customer mix’s average income is increasing. That benefit from improvement also showed up in more units in the basket (UPTs) and a better gross margin rate. In explaining General’s better results for the past two quarters, Vasos said, “Our store standards are much, much better than they’ve been in quite a long time, and every single quarter that goes by continues to get better and better. Our service at store as well, customer service continues to grow as well. And I would tell you that our customers are seeing that. We’re seeing that in the data that we get back on customer satisfaction scores are rising each and every quarter as well. Turnover continues to reduce at store level. That’s another initiative that we had that will add to the top line. Our turnover for the fifth straight quarter at retail has decreased. So again, we’re very proud of that stat. And then obviously, shrink plays a part of this. I’m sure we can talk about that later, but shrink, overall, you heard in our prepared remarks feels like we’re on the right track. And the reason why we believe it adds to the top line is if it’s there for the customer to buy and not being taken, then it will add to that top line. Very quickly on our supply chain, we feel really good about our on-time pieces. Not only are we hitting our goal, but we have sustained hitting that goal now for more than 2 quarters in a row, which is a trend. So we feel good about that. And then in full continues to get better and better. Our inventory at store level while down in total and same store, it’s up in availability to the consumer and is up and in a pretty good shape.”

Given the burgeoning increases in prices stemming from tariffs, Dollar General now looks to be in a better place than it has been for quite some time, both from a macro and retail-execution perspective.

LOGIN

LOGIN