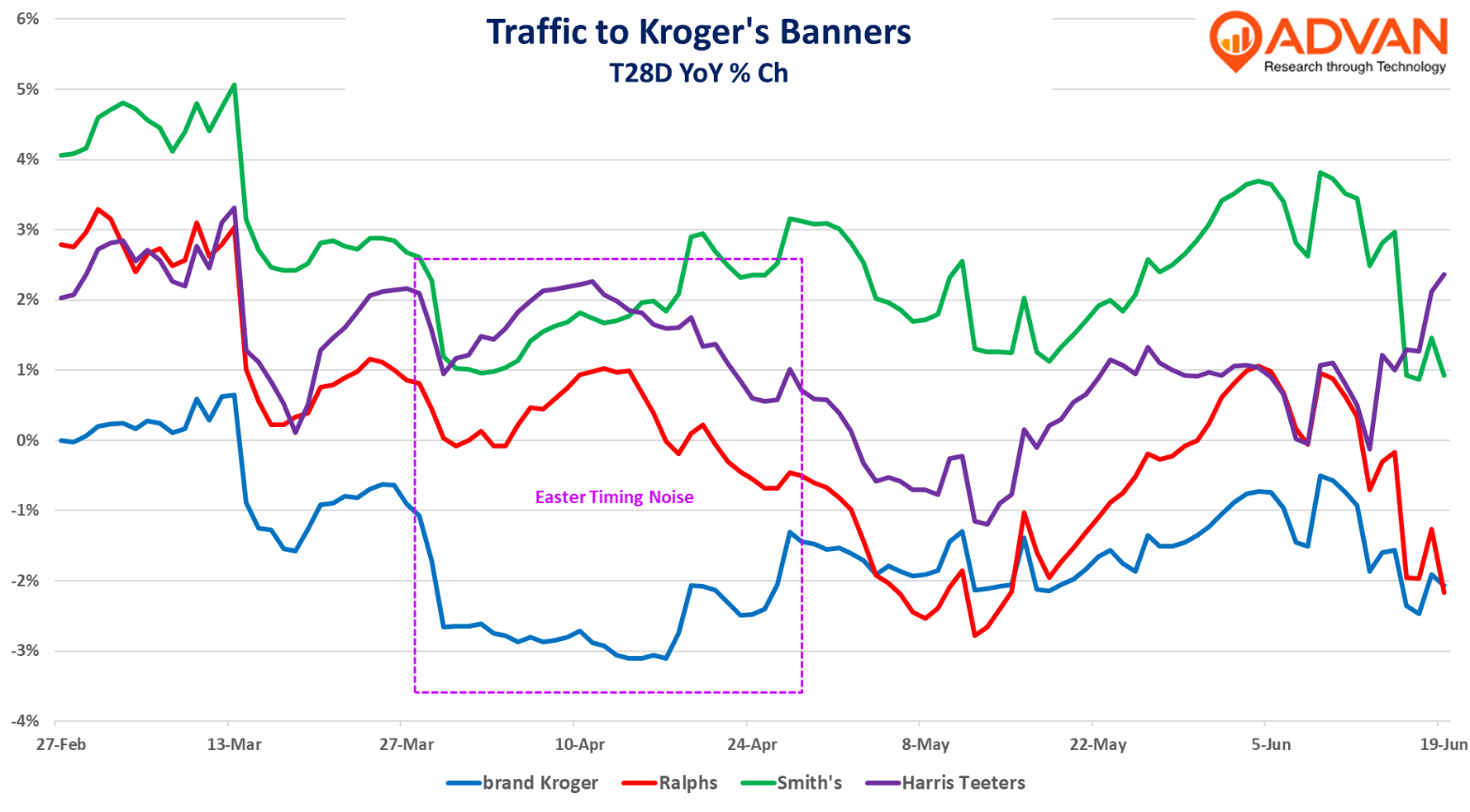

Advantaged by a strong owned-brands portfolio and fresh offering, Kroger reported better comp-sales (+3.2%) and gross margin for its quarter. The comp increase was also higher than Advan’s +2.9% estimate* and marginally ahead of the industry’s +2.9% per the Census’ monthly report . Kroger enjoys a larger lift from pharmacy (Wegovy, Zepbound, etc) and its fast-growing delivery business (the Ocado sheds). Stripping out the benefit of pharmacy lowers Kroger’s comp-increase to +1.8%; that’s less than overall food-at-home growth for the March - April period of +3.6% per the BEA . The higher market growth figure is lifted by the stronger sales at Costco, Sam’s, Walmart, Aldi, and Amazon. Looking at traffic by banner, brand-Kroger’s traffic was much weaker than its sister brands. Some of the lower growth is due to channel shift from the stores to the Ocado service, but it’s also due to share loss to Costco, Sam’s, Aldi, Trader Joe’s, etc. Separately, all of these figures are bolstered by share-of-stomach moving from away-from-home to food-at-home; more on that below.

As it relates to comp-sales, the traffic decline is largely offset by inflation, which was +2.0% for the period. Excluding digital, pharmacy, and inflation, volume / traffic was down about -2% due to center-of-the-store nationally branded volume (General Mills, Kraft, etc.) declining at a low- to mid-single-digit rate. On the flipside, delivery grew at a very robust +15% rate. Part of getting the store business to grow, is new stores. Interim CEO Ron Sargent said, “The biggest driver of market share for us relates to opening new stores. We have seen very modest store growth over the last several years during the merger process. We did see significant improvements in Q1 and we saw market share gains in markets where we have added stores… We are on track to complete 30 major [new store] projects in 2025. And looking forward, we expect to accelerate new store openings in 2026 and beyond in high-growth geographies… It’s also important to note that we paused our annual store review during the merger process. To position our company for future success, this morning, we announced plans to close approximately 60 stores over the next 18 months. We don’t take these decisions lightly, but this will make the company more efficient…”

On the consumer, Sargent said, “One factor that is kind of interesting is that inflation has been higher for food away from home or restaurants, inflation has been high for 27 consecutive months versus food consumed at home. I think both in high and low income levels, they’re navigating a significant uncertainty… Customers are looking for value. And I think when you look at how we respond to that, we’re always looking for ways to deal with the environment and bring value to our customers and whether that’s Our Brands, whether it’s having the right promotions, having the right promotional pricing. We are kind of seeing a shift into larger pack sizes and increased use of coupons… It’s a little softer in areas like snacks and adult beverages, pet, and general merchandise categories… We expect the consumer to remain cautious throughout the year. And we’re responding to that with simple promotions, coupons, lower prices, and a lot of owned brand choices.” In light of this state of affairs, that Kroger’s gross margin increased for the quarterly was an upside surprise (see the +10% move in the stock price); delivering the expansion demonstrated strong execution by the stores, supply chain, and merchants teams.

-Per the Maiden Century model based upon Advan’s traffic data.

LOGIN

LOGIN